By Galen Holley

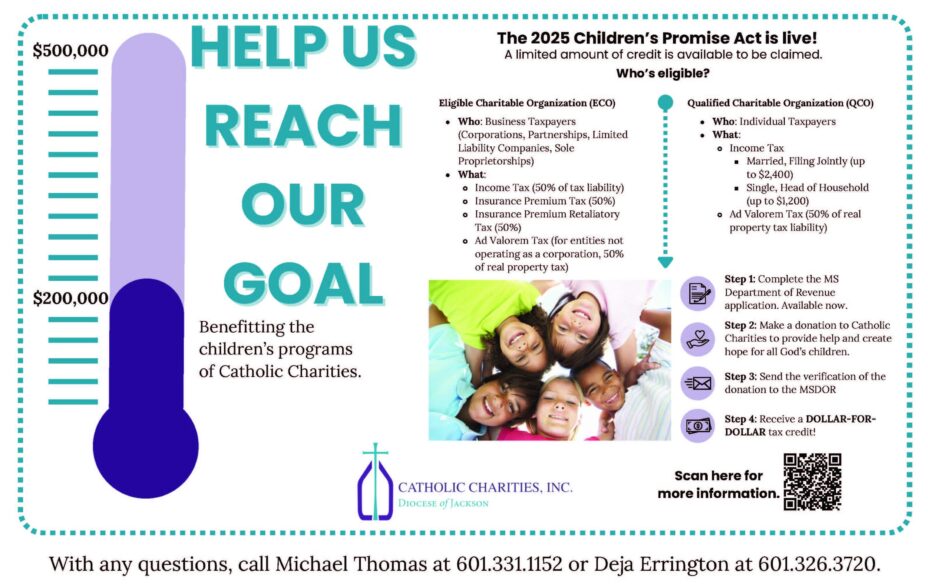

JACKSON – Donors who give to philanthropic causes approved by the Mississippi Department of Revenue, like many offered through Catholic Charities, are eligible for a substantial tax credit, thanks to a unique piece of legislation.

The Children’s Promise Act (CPA) provides a dollar-for-dollar tax credit, up to $1,200 for individuals, and up to half of their state tax liability for businesses, for making a donation to ECOs, or Eligible Charitable Organizations. The CPA provides tax credits to corporations, limited liability companies, partnerships, and sole proprietorships.

The Mississippi legislature passed the CPA in 2018. According to Monseigneur Elvin Sunds, interim executive director of Catholic Charities, Inc. of the Diocese of Jackson, it presents an incentive to support those on the margins of society.

“Many of the services we provide are funded by state and federal grants, but that money doesn’t always cover everything,” said Sunds. “The Children’s Promise Act helps fill in the gaps and allows us to continue those programs.”

Since the 1960s, Catholic Charities has served those in Mississippi who need a hand up. It’s a community effort, according to Sunds. “Catholic Charities has been out there, touching all aspects of community life, particularly serving women and children, and families,” said Sunds. Among its numerous outreach efforts, Catholic Charities in Mississippi provides round-the-clock service for children with emotional needs, as well as care for pregnant mothers facing addiction. Catholic Charities personnel try to make sure that children are always cared for. “We want to preserve those family bonds with which children are comfortable and familiar,” said Sunds.

Michael Crandall is the president at Trustmark Bank in Canton, as well a former board member at Catholic Charities. Trustmark recently contributed $100,000 to Catholic Charities, and the bank’s core values coincide nicely with the nonprofit’s efforts, according to Crandall.

“The Children’s Promise Act is an ideal opportunity for those who might not normally give to Catholic Charities to give,” he said. “Catholic Charities actually serves more non-Catholics than Catholics. It’s a community effort. One of Trustmark’s core values is building relationships within the community, and this is a perfect example.”

Michael Thomas is director of development at Catholic Charities in Jackson and said that the nonprofit is hoping to raise half a million dollars. To date, they’ve received about $200,000.

(To donate and take advantage of the tax credits offered through the Children’s Promise Act, visit https://www.catholiccharitiesjackson.org, email help@ccjackson.org, or call (601) 355-8634.)